us exit tax for dual citizens

972 3 519-7551 Fax. Charlotte NC 28201-1303 Do not use Forms 1040 1040A or 1040EZ.

Countries That Allow Dual Citizenship In 2022

In general taxpayers who want to claim tax deductions of up to Rs 15 lakh under Section 80C provisions and are willing to take some risk should consider investing in ELSS.

. This makes it one of the most popular tax saving schemes amongst investors. The Super senior citizens those above 80 years of age are not eligible to avail of the 87A rebate. FOR TAX DUE RETURNS you are enclosing a payment.

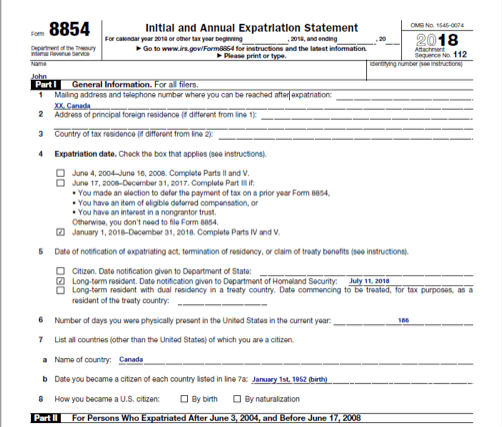

Date commencing to be treated for tax purposes as a resident of the treaty country. However if you are focussed on tax saving for income above 15 lakhs and the amount of exemption in tax sought by you is more than 25 lakhs it is prudent to stick to the old method of tax computation. International taxation is the study or determination of tax on a person or business subject to the tax laws of different countries or the international aspects of an individual countrys tax laws as the case may be.

The full page must be inside the frame including the 2 lines of numbers at the bottom of the page. 972 2 630-4000 Emergency After-Hours Telephone. ELSS funds provide the dual benefit of capital appreciation and tax-savings.

Citizens are also US. Income Tax Rebate Under Section 87A - Find out who can claim income tax rebate under Section 87A and the benefits offered under Section 87A for FY 2020-21 AY 2021-22. A benefit on early exit is available under Plan Option Life Secure.

US estate and gift taxes. Section 101a22 of the Immigration and Nationality Act INA states that the term national of the United States means A a citizen of the United States or B a person who though not a citizen of the United States owes permanent allegiance to the United States Therefore US. Conceptually citizenship is focused on the internal political life of the country and nationality is a matter of international dealings.

Multipledual citizenship or multipledual nationality is a legal status in which a person is concurrently regarded as a national or citizen of more than one country under the laws of those countries. A resident of the United States for tax purposes if they meet either the green card test or the substantial presence test for the calendar year. Let us understand this by looking at tax computation by both methods for a person drawing an yearly salary of Rs 20 lakhs.

Virginia ResidentNonresident Individual Income Tax Return. As mentioned earlier the exemption amount is 11400000 in 2019. Two dual nationals living abroad founded Americans Overseas.

Jane is a dual citizen of the United States and Country T and is a resident of Country T. Questions about dual citizenship. Citizens or green card holders who terminate.

JerusalemACSstategov Contact the Consular Section of the US. Governments usually limit the scope of their income taxation in some manner territorially or provide for offsets to taxation relating to extraterritorial income. US estate and gift tax.

Date you became a citizen of each country listed in line 6a see instructions. Embassy in Jerusalem for information and assistance in Jerusalem the West Bank Gaza and the. Embassy Jerusalem 14 David Flusser Street Jerusalem 93392 Telephone.

There is no international convention which. List all countries including the United States of which you are a citizen see instructions. If you have any questions about dual citizenship and the US tax obligation you can contact Americans Overseas.

Once any available annual exclusions or marital or other deductions are utilized the available exemption will offset taxable gifts or bequests. Take a picture of the photo page of your passport using your phones camera. Long-term resident with dual residency in a treaty country.

The 14th Amendment to the United States Constitution provides that all persons born or naturalized in the United States are citizens of the United States. Form 760 or Form 763. The United States has a tax treaty with Country T.

Jane has a net worth under 2000000. 972 2 630-4070 Email. You could still be in exceptional cases subject to a so-called exit tax.

This one imposes the income tax on the net unrealized gain on property held by certain US. And you may be subject to Exit Taxes under IRC 877A. State tax residency is defined differently than Federal tax residency.

In the costly and exhausting process of finding the right experts.

Renunciation Of Citizenship Answered Expat Us Tax

Do Dual Citizens Renouncing Us Citizenship Pay Expatriation Tax

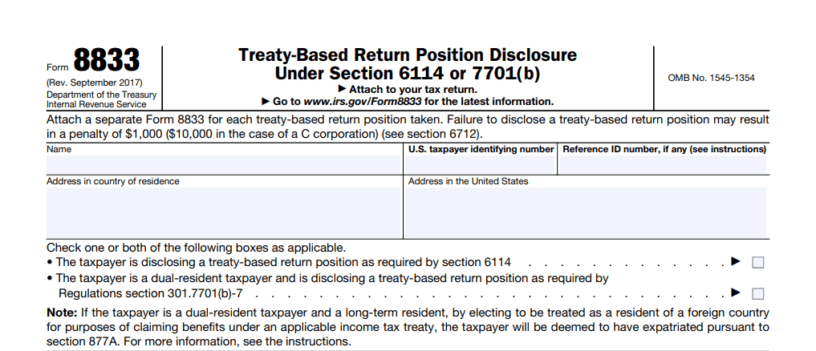

Form 8833 Tax Treaties Understanding Your Us Tax Return

Bookmark Japanese Citizenship Or Dual Nationality Everything You Need To Know Japan Forward

Gop Tax Law Snubs Us Expats And Accidental Americans

Green Card Exit Tax Abandonment After 8 Years

Do Dual Us Citizens Have To File Us Taxes

What Dual Citizens Need To Know Before You Renounce Us Citizenship

What Is Form 8854 The Initial And Annual Expatriation Statement

Taxes For Dual Status And Resident Aliens H R Block

Dual Citizenship Exception To Expatriation Substantial Contacts

Irs Dual Citizenship Taxes A Quick Reference Guide For Expats

Taxes For Dual Status And Resident Aliens H R Block

Tax Filing For Dual Citizenship Expat Cpa

Tax Guide For Dual Citizens Of The Us And Uk Greenback Expat Tax Services

How To Expatriate From The United States New 2021

The Dual Citizen Exception To The Exit Tax Expat Tax Professionals

Traveling As A Dual National Stick To The Rules And You Should Be By Philip Valenta Msf Traveleptica Medium