hayward ca sales tax rate 2019

Sales Tax in Hayward CA. Hayward CA Sales Tax Rate.

Why Doesn T The Us Include Sales Tax In Prices Quora

The latest sales tax rates for cities starting with H in California CA state.

. This rate includes any state county city and local sales taxes. California City and County Sales and Use Tax Rates Rates Effective 07012019 through 12312019 2 P a g e Note. Lowest sales tax NA Highest sales tax 1075 California Sales Tax.

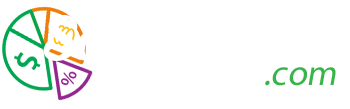

For a list of your current and historical rates go to the California City. The 975 sales tax rate in Hayward consists of 600 California state sales tax 025 Alameda County sales tax 050 Hayward tax and 300. Among major cities Chicago Illinois and Long Beach and Glendale California impose the highest combined state and local sales tax rates at 1025 percent.

The California State Board of Equalization BOE reminds Californians that that new sales and use tax rates are taking effect on April 1 2015 as a result of voter-approved. The five states with the highest average local sales tax rates are Alabama 514 percent Louisiana 500 percent Colorado 473 percent New York 449 percent and. The current total local sales tax rate in Hayward CA is 10750.

Total tax rate property tax. The Hayward Sales Tax is collected by the merchant on all qualifying sales. Many local sales and use tax rate changes take effect on April 1 2019 in California as befits its size.

Michael S Hours Michael S Store Hours Michael S Holiday Hours. The 975 sales tax rate in hayward consists of 600 california state sales tax 025 alameda county sales tax 050 hayward tax and 300 special tax. Hayward california sales tax rate 2020 the 975 sales tax rate in hayward consists of 600 california state sales tax 025 alameda county sales.

Home 2019 ca hayward rate. Hayward California Sales Tax Rate 2020 The 975 sales tax rate in Hayward consists of 600 California state sales tax 025 Alameda County sales tax 050 Hayward. California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated.

Hayward is located within Alameda. For tax rates in other cities see California sales taxes by city and county. What is the sales tax rate in Hayward California.

23 2019 Hayward Municipal Fleet Ditches Diesel For Renewable Alternative. California has state sales tax of 6 and allows local governments to. The average cumulative sales tax rate in Hayward California is 1075.

The Hayward California sales tax is 975 consisting of 600 California state sales tax and 375 Hayward local sales taxesThe local sales tax consists of a 025 county sales tax a 050 city sales tax and a 300 special district sales tax used to fund transportation districts local attractions etc. This includes the sales tax rates on the state county city and special levels. While the State of California only charges a 6 sales tax theres also a state mandated 125 local rate bringing the minimum sales tax rate in the state up to 725.

Average Sales Tax With Local. May 22 2019 Hayward Among Leading Group Of Cities Scoring An A On Climate Leadership. The minimum combined 2022 sales tax rate for Hayward California is.

2020 rates included for use while preparing your income tax deduction. City sales and use tax rate changes Alameda Alameda County. The 1075 sales tax rate in Hayward consists of 6 California state sales tax 025 Alameda County sales tax 05 Hayward tax and 4 Special tax.

This is the total of state county and city sales tax rates. 2020 rates included for use while preparing your income. The latest sales tax rate for Hayward CA.

You can print a 1075 sales tax table here. The city council could impose a lower tax. Hayward ca sales tax rate 2019 Monday February 28 2022 Edit.

The December 2020 total local sales tax rate was 9750. Next to city indicates incorporated city City Rate. Hayward California Sales Tax Rate 2020.

Rates include state county and city taxes.

Why Does California Have Some Of The Highest State Income Tax And State Sales Tax In The Country Quora

Wisconsin Sales Tax Rates By City County 2022

Alameda County California Sales Tax Rate 2021 Avalara

Why Does California Have Some Of The Highest State Income Tax And State Sales Tax In The Country Quora

Sales Tax Rates Rise Up To 10 75 In Alameda County Highest In California Kesq

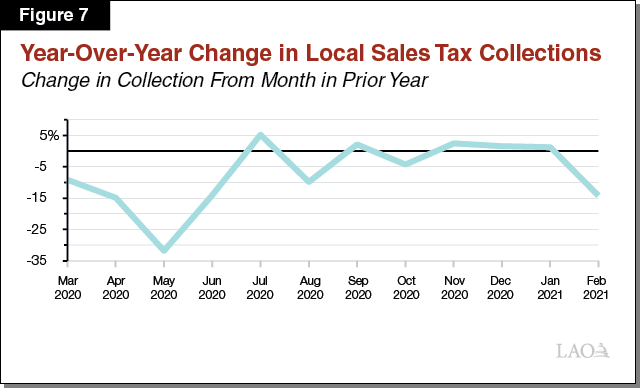

The Cities With The Highest And Lowest Property Taxes Real Estate Buffalonews Com

The Cities With The Highest And Lowest Property Taxes Real Estate Buffalonews Com

California High Taxes Obsessive Tax Collectors National Review

California Sales Tax Rates By City County 2022

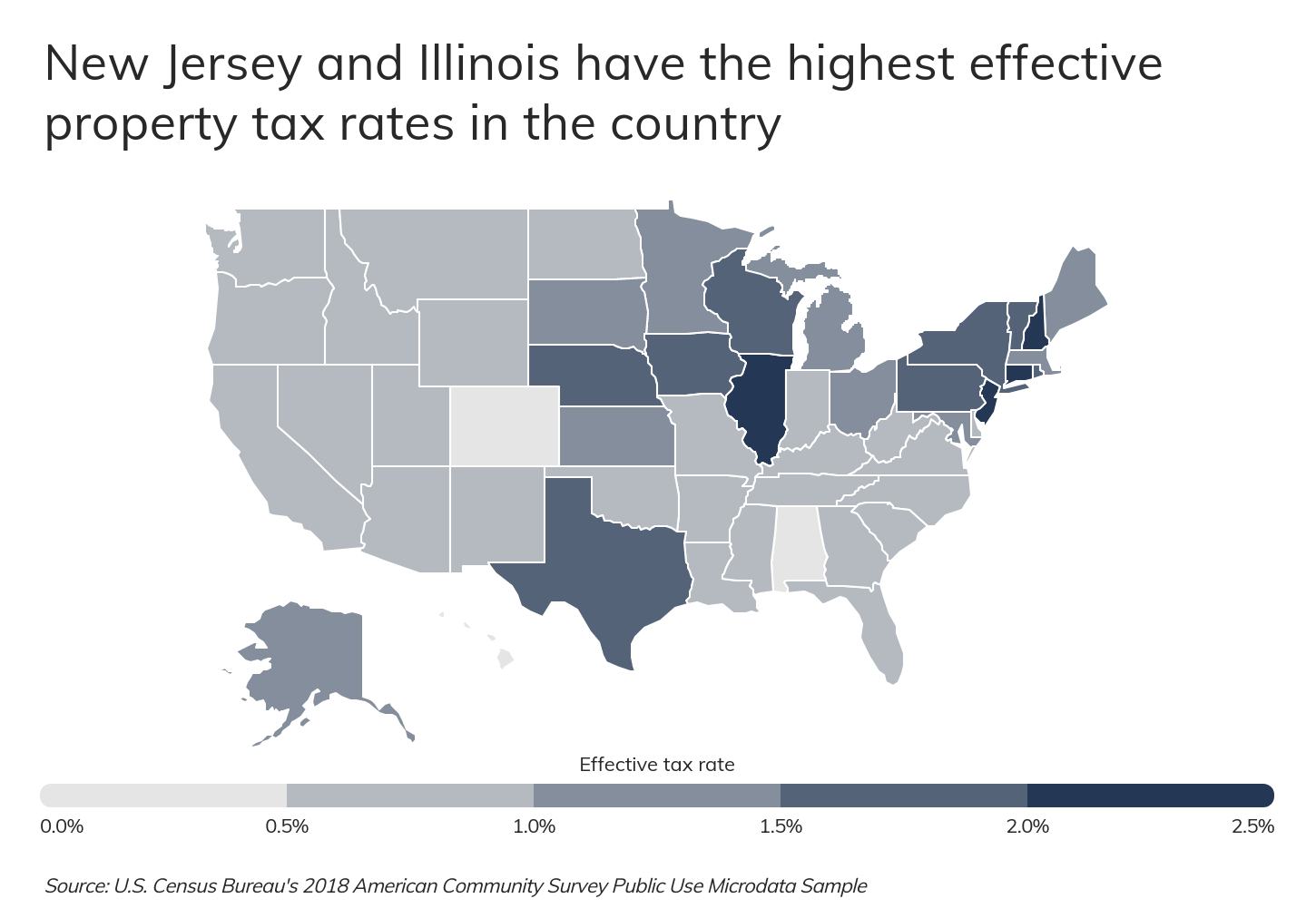

An Initial Look At Effects Of The Covid 19 Pandemic On Local Government Fiscal Condition

Wisconsin Property Tax Calculator Smartasset

How To Use A California Car Sales Tax Calculator

The Cities With The Highest And Lowest Property Taxes Real Estate Buffalonews Com

California State County City Municipal Tax Rate Table Sales Tax Number Reseller S Permit Online Application